Dateline: September 23rd 2019

The Boys are Back in Town

Last week’s batch of data from the US and Eurozone economies did little to clear the fog around near-term direction. Business confidence remains especially low.

One thing is clear though – Central Banks are centre stage – again.

Members of the US Federal Reserve said they would take whatever action was appropriate to sustain the economic expansion. This probably means interest rate cuts during the year with some members, such as James Bullard, wanting cuts immediately.

Mario Draghi, ECB president was equally “dovish” promising rate cuts, more bond buying and strong pledges on how long rates would remain low, if economic conditions fail to improve. All eyes on Central banks then!

In further evidence of their critical role, President Trump has managed to complain about both central banks in the past week!

Of course a successful life-enhancing Brexit or an outbreak of sweetness and light in Sino-US relations at the G20 could change the picture.

(Still something worrying at the back of the mind, when policy makers say they are concerned about growth and stock markets go up!)

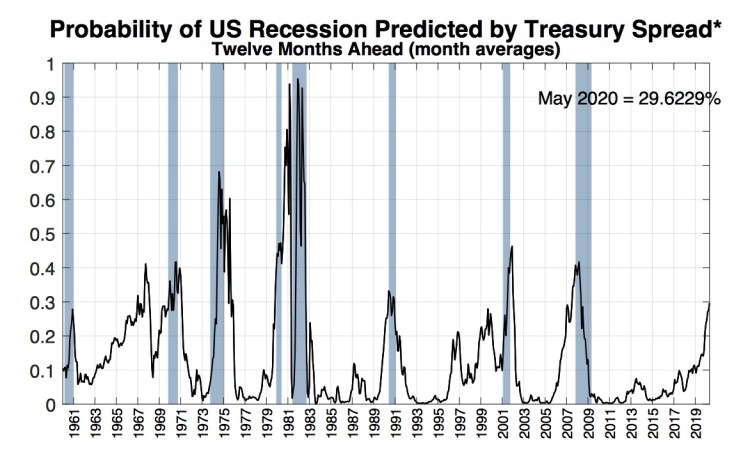

So, despite its pedigree the inverted yield curve may not be getting the universal acceptance it thinks it should merit. Why might it have lost some of its power?

So, despite its pedigree the inverted yield curve may not be getting the universal acceptance it thinks it should merit. Why might it have lost some of its power?

We are smack bang in the middle of the “market outlook 2019” season. Despite the fact that economic and market fundamentals don’t really recognise the Gregorian calendar, economists, strategists, commentators et al, rush to give their views on what the next 12 months holds – usually conveniently forgetting what they may have said at the start if 2018!

We are smack bang in the middle of the “market outlook 2019” season. Despite the fact that economic and market fundamentals don’t really recognise the Gregorian calendar, economists, strategists, commentators et al, rush to give their views on what the next 12 months holds – usually conveniently forgetting what they may have said at the start if 2018!

What do you think? Do they know their Verdi from their

Vardy?, Van Gogh from Van Morrison, or their Rigoletto from their cannelloni?

Hard to know really!

But this culture thing seems to be getting more and more attention.

In Ireland the Central Bank has been devoting a lot of resources to this issue

and getting the banks to refresh/redefine/find their appropriate culture.

My initial reaction used to be that this type of thing was a

bit waffly, with little real world application. Management consultants immersed

themselves in these concepts, and for a reasonable fee their clients could dip

a toe in, as required.

But if we strip away a lot of the jargon and think of

culture as just being “the way we do things around here” (Bower), I think it

becomes more meaningful in an asset management context, and should be

considered in evaluation, selection and review of managers.

Towers Watson and Roger Urwin have been flying the flag on

this for many years. Since the early 1990s it has been a critical component in their

formal manager evaluation. For them, culture is a unique ingredient in

generating alpha and a bedrock on which a competitive advantage is sustained

over a long term. They have published good research on the topic, seeking to

define and measure what constitutes culture in an asset management context.

This is by no means an exact science. Factors involved will

typically include leadership, ownership, procedures, policies, diversity, respect,

remuneration etc.

Should we care? – or should we only care about investment

outcomes.

Positive culture should underpin alpha generation and

importantly (in my view) its persistence. However there my be times when strong

performance can disguise a weak culture. Equally weak performance can

exacerbate culture issues.

How does a solid asset management culture deal with

disappointing performance. I read one of GMO’s quarterlies recently where they

spoke about the importance of “crying over spilt milk”. This means when things

go wrong, try and understand why, and see what might be done better. Other

managers speak of having a WWW (what went wrong) wall, noting poor investment

decisions and focussing solely on the learning points. I think that

acknowledging poor performance (because it will happen!) is a necessary and

positive aspect in a good asset management culture. Investors and selectors

should view it similarly.

In recent weeks, a named lead manager for a large

blockbuster fund that had been through over 5 years of failure to meet targets,

suddenly announced a decision to leave. So I presume there had been 5 years of

meeting with clients justifying and defending performance and process again and

again. But conviction may have morphed into stubbornness and It seems to me

that the final outcome (manager departure) didn’t really do clients any

favours.

Maybe a culture where there was some crying over spilt milk

and learning opportunities sought along the way would have served clients (and

the asset manager) better.

What do you think? Do they know their Verdi from their

Vardy?, Van Gogh from Van Morrison, or their Rigoletto from their cannelloni?

Hard to know really!

But this culture thing seems to be getting more and more attention.

In Ireland the Central Bank has been devoting a lot of resources to this issue

and getting the banks to refresh/redefine/find their appropriate culture.

My initial reaction used to be that this type of thing was a

bit waffly, with little real world application. Management consultants immersed

themselves in these concepts, and for a reasonable fee their clients could dip

a toe in, as required.

But if we strip away a lot of the jargon and think of

culture as just being “the way we do things around here” (Bower), I think it

becomes more meaningful in an asset management context, and should be

considered in evaluation, selection and review of managers.

Towers Watson and Roger Urwin have been flying the flag on

this for many years. Since the early 1990s it has been a critical component in their

formal manager evaluation. For them, culture is a unique ingredient in

generating alpha and a bedrock on which a competitive advantage is sustained

over a long term. They have published good research on the topic, seeking to

define and measure what constitutes culture in an asset management context.

This is by no means an exact science. Factors involved will

typically include leadership, ownership, procedures, policies, diversity, respect,

remuneration etc.

Should we care? – or should we only care about investment

outcomes.

Positive culture should underpin alpha generation and

importantly (in my view) its persistence. However there my be times when strong

performance can disguise a weak culture. Equally weak performance can

exacerbate culture issues.

How does a solid asset management culture deal with

disappointing performance. I read one of GMO’s quarterlies recently where they

spoke about the importance of “crying over spilt milk”. This means when things

go wrong, try and understand why, and see what might be done better. Other

managers speak of having a WWW (what went wrong) wall, noting poor investment

decisions and focussing solely on the learning points. I think that

acknowledging poor performance (because it will happen!) is a necessary and

positive aspect in a good asset management culture. Investors and selectors

should view it similarly.

In recent weeks, a named lead manager for a large

blockbuster fund that had been through over 5 years of failure to meet targets,

suddenly announced a decision to leave. So I presume there had been 5 years of

meeting with clients justifying and defending performance and process again and

again. But conviction may have morphed into stubbornness and It seems to me

that the final outcome (manager departure) didn’t really do clients any

favours.

Maybe a culture where there was some crying over spilt milk

and learning opportunities sought along the way would have served clients (and

the asset manager) better.