Yes – until they don’t.

What I’m talking about here are the models, processes, frameworks that some investment managers may use when they are allocating across the various asset classes such as stocks, bonds, property, cash, alternatives etc.

The usual building blocks of such models may include factors such as valuation, economic growth, interest rates, currencies, bond yields, momentum, geo-political risk etc. These factors are often given a weight and scored to come to a ranking of assets and final portfolio.

Do all of these factors matter to markets?

Absolutely.

The problem is not all at the same time; their impact and importance wax and wane through time.

There will be periods of substance and periods of irrelevance. For example there are times when currency moves can appear to be the key focus of markets. At times in the 1980’s, for example, Yen/Dollar and Japanese trade data were the touch paper for the World’s equity markets.

Economic growth has also been important at different times. But even if you can correctly forecast the shape and direction of the economy (no mean feat in itself) , forecasting the asset market response is a different matter. We could well be in a “bad news is good news” environment, as the market reaction can be based more on how a Central Bank might react rather than the level of underlying activity.

Long term performance of such models has been poor. Research suggests little real value-add on average after costs. In the hedge fund world so called “Global Macro” funds which are a transparent way of gauging how effective these strategies are, shows them to be among the worst categories. In fact, over the last five years to date performance has been negative – in a period when the S&P 500 stock index was up over 50%.

There is a risk that if a sophisticated investment process has been constructed, there is a temptation to slavishly follow the turn in every outcome, and to “tinker”. The literature on this subject points to making the right strategic decision, doing so in a meaningful manner and then doing as little as possible. The legendary Charlie Munger has said:

“The wise ones invest heavily when the world offers them the opportunity.

And the rest of the time they don’t”

If there’s nothing to do, do it.

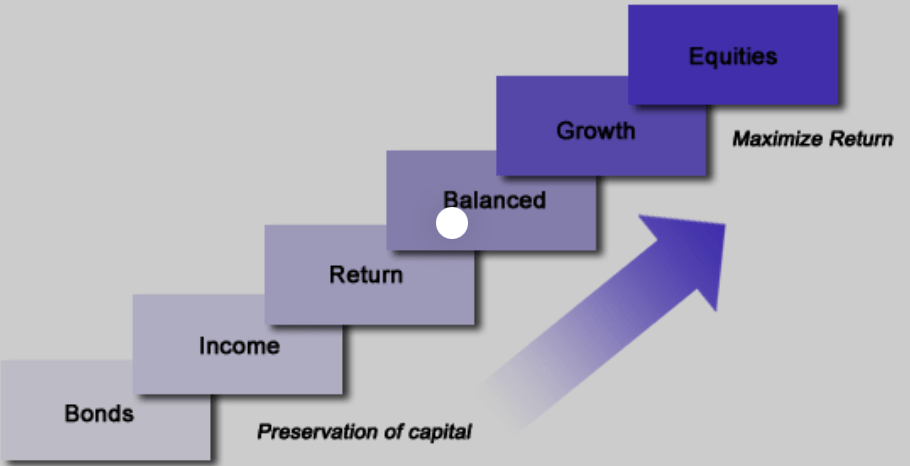

It can be useful to think of the investment universe in broad terms of “regimes” as these may have a longer life span and be easier delineated than many themes.

For example, are we in a rising interest rate regime or a falling one? This then determines an asset bias and may also point to what style might be prevalent within stock portfolios.

Is it a regime of falling or rising valuation multiples? Again this can be reasonably well defined and help us in deciding whether to be aggressive or cautious in portfolio construction. The particular strength here is as an aid to avoiding downside. Protecting against downside risk is one the most powerful portfolio management tools there is.

Even if an investment process appears to be delivering, that’s when real vigilance is called for. In renowned fund manager Anthony Bolton’s view, that’s “the period of maximum risk”

David Swenson, the fund manager’s fund manager, stresses the quality, integrity and discipline of the manager, rather than the sophisticated models shown in the power-point slide. He does want to be as diversified as practical to ensure the best risk adjusted returns.

In short – the message from proven market experts seems to be not to slavishly follow investment models, but to be diversified, disciplined and decisive.

Eugene,

I hope you’re well. That’s a thoughtful piece.

I think you are on the money on two points in particular:

Regime idea – these are generally infrequent but significant and can often be highly predictable. Inevitability of interest rates rising post the free money era up to quite recently was an obvious example, but there are plenty of others. Deglobalisation for example is a forward looking regime shift from here that I feel is pretty inevitable for the next decade at least. 2. Avoid downside – my favourite (extreme) illustration of this is if you have a two-year average of 0% return: with +50% and -50% you end up with €75, but +1% and -1% sees you end up with €99.99.

Ultimately I feel portfolios need to be based on a long-term resilience idea, diversified across assets that can perform under various growth / inflation / interest rate environments. And adjust that just for the regime change ideas. Which is maybe partly where you have got to at the end.

Kind regards,

Eugene

Eugene O’Callaghan

Business & Investment Advisor

t: +353 (86) 834 2385

e: eugeneocallaghan5@gmail.com eugeneocallaghan5@gmail.com

LikeLike

Many thanks for reading and for very solid comments! Eugene

LikeLike