We see regular coverage of how different industries and sectors are doing during this pandemic economy. It’s obvious, for example, why airlines would be among the hardest hit as flights fall away, or why e-commerce names, such as Amazon, would benefit from the tailwind of changing consumer behaviour.

Investment managers in fact seek to profit from recognising and evaluating these trends in their decision making. It’s a reasonable question to ask how are these managers themselves and their industry doing.

How are the asset managers managing?

Investment managers make profits by charging a small percentage on the quantity of assets they manage. So the more that these assets can grow, the more revenue and profit achieved. The two main ways this can happen are asset markets going up, or managers being able to gather new business. Costs can be relatively fixed so the big attraction of asset management is its “scaleability” – profits can grow dramatically as assets under management rise.

There’s no doubt asset markets have been volatile in 2020 – collapsing in February but recovering materially from March onwards, and now in some cases making new highs. Looking at global equities as a proxy for overall asset values, we are, at time of writing, ahead on where we started the year. Other asset classes such as bonds have in fact posted positive numbers year to date. So far this has not been a long drawn out bear market eating into the value of assets under management.

This relatively benign backdrop has been supportive for the share prices of asset managers. We can see this in the performance figures from the US market. While the overall Financials sector, which includes Banks, has been hammered, the Capital markets sector, which includes asset managers, is actually in positive territory along with the market overall. And given that the overall S&P index has been boosted by the stellar performance of the likes of Amazon, Google etc. this is a very solid performance from asset management companies.

Sector Performance YTD

Asset Managers +1%

Financials -20%

Overall Market +4%

The picture is broadly repeated in the UK where the leading asset managers have comfortably outperformed the All Share index.

So share price performance reflects an industry which is holding its own.

So market values are better, what about fund flows, that other critical factor in profitability?

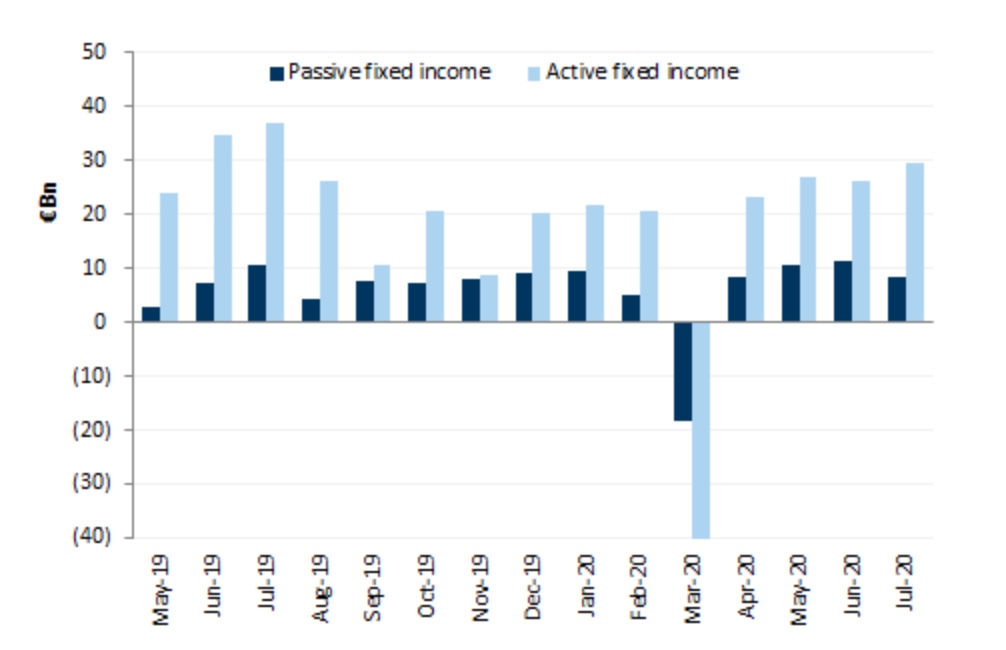

Based on Morningstar data, 2020 has been a year of positive flows for both equity and bond managers in Europe. There was a significant once-off outflow in March as markets stumbled, but every subsequent month has been positive and the lost ground fully recovered. This again helps asset management profitability. The picture is more nuanced in the US with bond managers seeing very strong inflows over the year but equity managers facing asset losses. For active equity managers, this was merely a continuation of a well-established trend as they lose out to passive products.

Earlier in the year, there were some dire forecasts on the outlook for the asset management industry – job losses of 15% or more, cuts in compensation. This was based mainly on market volatility and what was seen as a “challenging” marketing environment.

The market rebound and continued positive fund flows have taken the edge off the gloom and doom.

Some management groups have looked to take opportunities of the environment. One large wealth manager in the UK is hiring an extra 100 financial advisors but also laying off more or less the same number in order to “up productivity” levels.

Other managers have noted how they benefitted from unanticipated cost savings. Schroders noted at half year that their travel and marketing spend was lower by £15M, as they simply travelled less!

Other broad trends remain in place over the past year despite the pandemic;

Flows into ESG products remain robust

*Mergers and acquisitions remain central to many corporate strategies e.g. Liontrust, Franklin Templeton

*Passive continues to win over active, especially in the US

*Institutional business continues to be more stable than retail.

*Asset management continues to be a very attractive business (favourable demographics, savings requirements etc.) and this hasn’t been derailed by the last 8 months.

However, remote working and the world of Zoom meetings may play a role in the competitive landscape. Certainly some of the softer, yet critical, issues such as trust and confidence are more difficult to address remotely. Peter Harrison, CEO of Schroders, noted last month the importance of having an existing relationship with the client, and being part of the “ecosystem”. He thinks it may be more difficult for challengers to establish new relationships.

Overall fund flows and financial market performance may be supportive for the overall industry.

But for asset managers maybe the challenge in today’s environment is less about overall business levels and more about the competitive dynamic, and how to win new business from a new client.