It may be the most important decision faced by all investors be they pension trustees, family offices, multi-managers or individuals – and it’s a lot riskier than you might think.

There are a range of scenarios where the trigger will need to be pulled and some are quite straight-forward.

Trust: This is a key feature of a healthy relationship between fund manager and investor and if for any reason this is compromised it’s a strong reason to move. This could be a breach of data or confidentiality and while it may not impact on current performance, it does not augur well. Surveys show that this is actually the top reason for getting investment managers fired. A CFA study showed that 30% of institutional investors do not trust the asset management industry!

Reputation: Do any changes/statements/decisions at or impacting on the fund management company impact on your reputation or your relationship with customers, peers, sponsors etc. Increasingly this can be prompted by the industry regulator. Again I think this is relatively clear cut.

Manager moves: What if a great manager moves on elsewhere? Do you follow? Do you stick with the current management company? My experience has been that there is no single answer. I’ve seen managers move and carry on with excellent numbers without skipping a beat . I’ve also seen “moving managers” crash and burn. Best option is refresh your primary due diligence on both original and destination set up.

Performance: This is the tricky one and the one where I suspect most trustees or groups spend time on. How long do you accept under-performance? 6 months?, 2 years? Many will feel some form of “emotional” investment with the manager choice and hope for a turnaround. It becomes an issue at each and every meeting. It’s natural just to want to be rid of the “problem child”. In the end it can often be just capitulation leading to the firing.

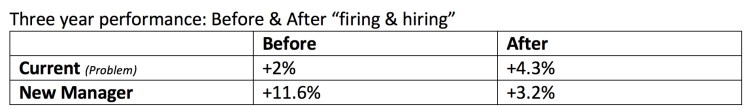

However the performance numbers suggest it can turn out to be a bad decision. Investors often buy into a manager who has already been doing well and sell out just before the old manager begins to recover.

You can see how high turnover of managers based on performance can eat into long term returns.

Performance is the riskiest set of issues around which to change a fund manager.

Style Drift: This can be like the US Navy SEAL of factors – silent and deadly. Basically if the manager changes what they are doing from what they said they would do, it’s time for a change. This can happen over time and performance may continue to be delivered but failure to identify such trends can have a major negative impact on fund returns and indeed investment capital itself. For example if a manager had a long term profile and history of investing in liquid large cap income-producing stocks, but begins to move into illiquid technology and bio-science smaller companies, alarm bells should ring. There is currently a high profile example of this.

Red flags here can appear early, and close monitoring of portfolio holdings is the key to taking prompt action.

The toughest thing can be leaving a manager who is performing well. A tough thing as well can be allocating new capital to a manager whose performance is slipping. Both should be considered in the overall portfolio management