Today , October 1st, we saw a battery of weak numbers from the manufacturing sectors from the US and Europe. These were the PMI’s (Purchasing Managers’ Indices) – which should give a timely and forward looking indication of the underlying health of the manufacturing base. For the US, we saw the weakest number for a decade. In Europe, while there is universal slippage, Germany is especially hurt, with the steepest downturn for nearly 7 years.

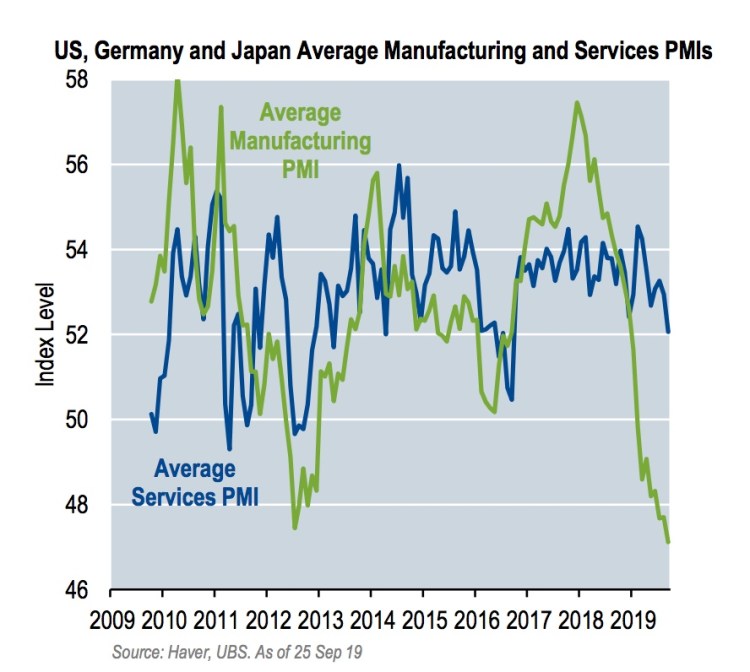

What has been interesting to date, is how services and the consumer have held up despite the manufacturing malaise – as the graph above shows:

It’s hard to see how this gap can persist if we get continued poor news from manufacturing sector.

And the most likely transmission mechanism is jobs.

In Europe, according to the PMI Survey, jobs are now being cut at the fastest rate since 2013.

The risk then would be that a deteriorating jobs market hits households and the service sector.

In this Friday’s US jobs data, attention should be paid as much to measures such as overtime or hours worked, as to the overall unemployment rate.