Yup – it doesn’t rank as the most enthralling of topics, but there are some folks who are obsessed by it. Now if they work in the investment/economic milieu there may be an excuse for that, but if they are in the real world, it may be time to seek help.

Why does it matter and what is it?

The inverted yield curve is regarded by many as the best single predictor of an economic recession around the corner.

The yield on government bonds (that is the interest rate that the market demands for holding them) should get higher as those bonds get longer. For example, the yield on a 10 year bond should be higher than on a 2 year bond and that for a 30 year bond higher than the 10 and so on. Investors typically demand higher returns for locking their money up for longer periods. This is to compensate them for higher economic risk such as an outburst of inflation or a payment risk.

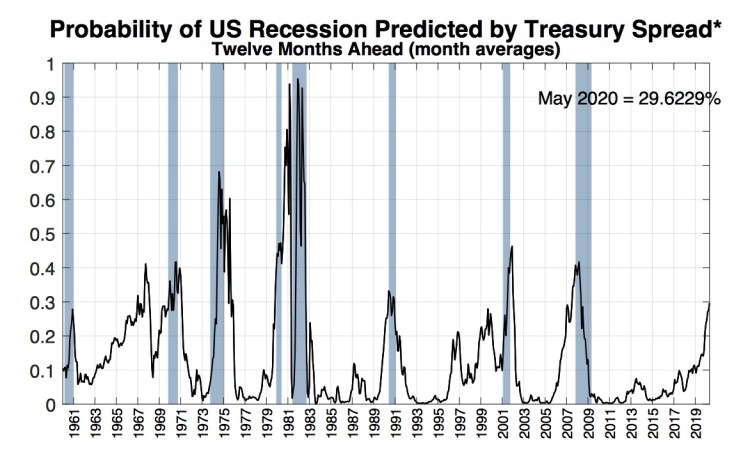

When that is not the case – when yields are turned around (or inverted) it sets alarm bells ringing for many commentators. It has a good track record. In the US, whenever the yield curve has inverted, in the last 60 years – with one exception in the late 1960’s – a recession has followed.

What’s the rationale for this. The shorter end of the bond spectrum is likely to reflect the Central Bank’s policy on interest rates, so rising rates to choke of inflation or growth has a knock on effect on them. This naturally can lead to lower growth.

We have recently moved into that territory. Today in the US, 10 year bond yields are about 2.08% while shorter 3 month rates are 2.2%. Is a recession imminent?

The US economy looks OK at the moment though everyone acknowledges this has been a very long expansion. The New York Fed see the probability of a recession in 2020 at 30% currently. This is probably a bit lower than the followers of the inverted yield curve society would be thinking.

So, despite its pedigree the inverted yield curve may not be getting the universal acceptance it thinks it should merit. Why might it have lost some of its power?

So, despite its pedigree the inverted yield curve may not be getting the universal acceptance it thinks it should merit. Why might it have lost some of its power?

We are at extremely low bond yields already after the greatest monetary experiment ever and unprecedented bond buying by the world’s Central Banks. That has to play some role.

Also longer dated bonds typically have built in this premium because of inflation risk etc. Inflation has not been on the agenda for a number of years, is not an issue currently and market forecasts, 5 and 10 years out, see it as being very benign.

What does this mean in the short term?

Many board members of the US Central Bank keep track of the yield curve and would, if there was an overwhelming signal of an imminent recession, look to cut rates. Others will take a more balanced view of the economy and weigh up the pockets of strength against the weaker areas, as well as signals from the bond market. Some talk of an “insurance cut” i.e. to smooth market behaviour in case of any further tariff escalations.

All in all this could push us into a “wait and see” stance.