Tommy Tiernan has a brilliant piece where he discusses the global debt situation. It’s not a typical topic in stand-up comedy and well worth a look on YouTube.

He says we all owe – Germany owes billions of gazzillions, while England owes trillions of willions of billions and as for the US it owes so much it’s not even a word; it’s a primordial screaming deafening noise.

(Tiernan also has a solution to this debt problem)

It’s not clear how much Tiernan based his views on the 2012 work by Reinhart and Rogoff noting that countries with high debt levels face massive losses of output often lasting more than a decade.

What are the numbers? Global debt last year was $243 trillion. That’s just over 3 times the size of the global economy! This is actually higher than it was in 2008 – and that was when all the trouble started.

The debt is held by corporates and governments and mainly in China and the US.

It’s a topic that we are always being warned about from the likes of the IMF, OECD, World Bank, Institute for International Finance as well as the rating agencies and the media. Talk of debt sky-rocketing and words like impending crisis, financial time bomb and catastrophe mark the debate.

The IMF says that our financial vulnerability remains elevated – which I think means

*We have too much debt

*It’s growing too fast

*The quality of the debt is getting worse

The IMF is concerned that these debt levels are handicapping governments’ ability to increase spending or cut taxes to offset any weakening economic growth.

And at the company level we are seeing shareholders in some cases pushing for balance sheets to be restored to some degree. This certainly emerged in investor calls with companies like Verizon, AT&T and AB InBev in recent months.

But apart from the constant warnings and the company promises to reduce bloated balance sheets, financial and market life seems to roll on. Whenever markets have a few bad days, global debt gets rolled out as an excuse and then quietly slips into the background again.

So is it a thing?

I think it is something, which if we are entering tougher times, will make it more difficult to respond effectively, and this weaker policy response may exacerbate any slowdown. It’s like the road directions you get in Ireland “Well if I was you, I wouldn’t start from here.”

The fact that a lot of the corporate debt is poorer quality (lent to companies with weaker balance sheets etc.) is also important. In the US we have seen the weaker type of corporate debt, such as what has labelled BBB go from 30% of all debt in 2008 to 55% in 2018. This probably means that if things do go pear-shaped we could potentially see higher default rates than in previous cycles.

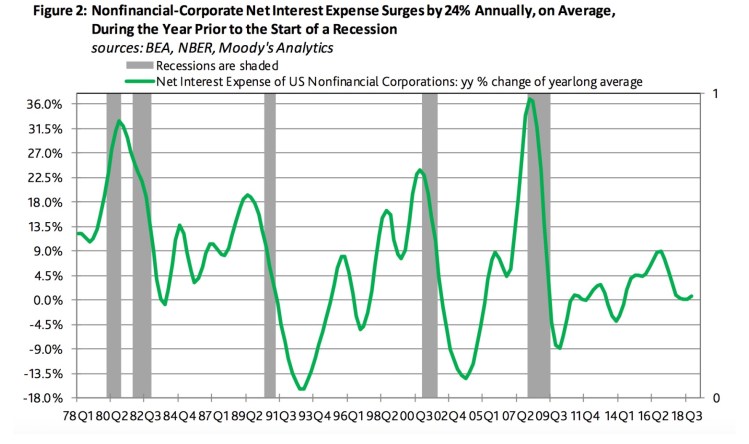

But……….. today, this week, this month it’s hard to think this monster debt level should have a huge impact or indeed on its own prompt a downturn and the picture below holds the key. It looks not at the level of debt but at the interest costs of that debt.

Debt levels are at extreme highs but the cost of that debt is at extreme lows. The graph is from a recent report from Moodys and they note that the 5 recessions since 1979 were prompted by a surge in interest expense, whereas wehave seen interest costs at very low levels and declining. As you can see, the current position of the green line is way below previous stress levels.

The key here is that interest rates remain low. This clearly depends on things such as inflation and if you want comfort on that, Lawrence Summers said in a speech in April that in his view current levels of inflation and interest rates are here for the next 10-15 years!