How did we get here?

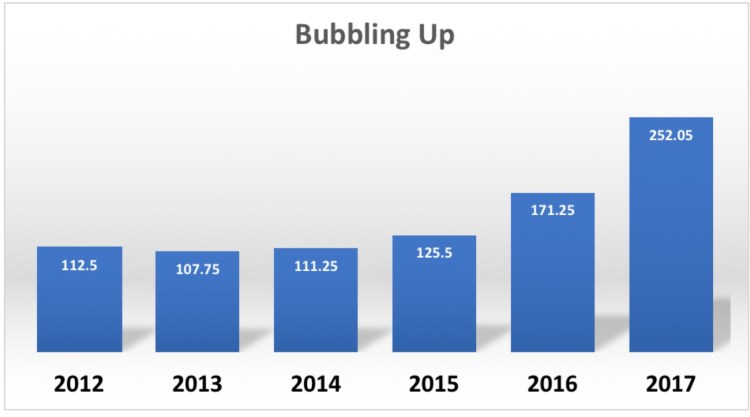

Look at the graph below. It’s not about GDP or the S&P 500 or CPI – it’s more important than that. This is how much gin we have consumed in Ireland in the past six years. Total growth over that period? – about 125%!

Probably doesn’t come as a complete surprise. It’s a trend that has garnered newspaper and magazine articles, and pubs have gone from having one gin bottle on a dispenser to a smorgasbord of offerings laid out on a menu.

Source: IWSR 000’s case

Still though – 125%?

Why?

Why gin? Why now? Why so successful?

Firstly what it’s not.

This is not an Irish phenomenon – it’s practically global. We have seen it in the UK, Europe, Australia. India is currently seeing a growth rate of over 12% per annum.

The real surge in growth in Ireland is from 2015 onwards and I suspect 2018 figures will confirm that trend. So it’s not just a general economic recovery story as we were reasonably out of the woods by then.

And yes, it is off a reasonably small base but that base was close enough to the likes of rum, brandy, scotch, and other liqueurs, many of which have actually seen a drop in consumption over the same period.

So what was it that has led to this phenomenal growth?

I don’t think there was one blockbuster reason but rather a conflation of a number of factors.

We did see some innovation and investment from some of the “majors” such as Hendricks and Bombay with some change of taste and market positioning. They were seeking to gain a wider (and younger) appeal, establish a premium drink and get rid of what had become a stale old image.

It also helped that at the same time there was somewhat of a revival of interest in cocktails. Many “mixologists” drew upon vintage sources and books like Harry Craddock’s “Savoy Cocktail Book” (1930) for inspiration. Many of the classic recipes relied heavily on gin because of its versatility and lighter touch.

Also getting the word out was also made significantly easier as Gin’s targeted core audience was also the most active and engaged social media demographic. Details on events, brand stories, promotions etc. could be spread well beyond what previous drinks could have achieved.

Gin was also able to latch on to an existing trend. Gin overall, but especially from smaller batch distillers, with its use of botanicals and local natural ingredients was able to catch a wave around concepts like freshness, organically grown, wild harvested, that was emerging especially in the much vaunted millennial segment. This was a similar concept to what many craft beers have benefitted from.

And as the demand rose so did the supply.

While imported gin still dominates the market here in Ireland, the growth in locally produced gins has been one of the outstanding features. Reports suggest about 50 Irish brands from 20 or so distilleries currently in production.

The economics of production are very supportive certainly compared to say whiskey. There is no need to lay stocks down for a number of years but gin can be shipped straight away both domestically and overseas. In fact some of the new local gin production came from whiskey producers using existing plant while they waited for stocks to mature.

The Irish Spirits Association has clear roadmap that should see local production outpace global trends – looking to treble over the next three years.

This new local supply adds to the general “buzz” around the product.

Gin has a long history especially in England and at various times has not enjoyed the best of reputations. Previous surges in consumption have been accompanied by instances of mass displays of public nudity and spontaneous combustion in women! To date, this current uptick seems to have been free of such occurrences.

Will it continue? It is difficult to see the pace of growth continue but at some point it will plateau. In the UK it has now been included in the basket of goods used to calculate inflation so the Office for National Statistics feel there is a degree of permanence about it. So in the near term there are no signs of the bubbles bursting.